I’d be lying if I said every time I enter my information in an application and press “apply” I didn’t secretly have a little rush of adrenaline and anticipation of the hopefully-quick (and positive) outcome. There’s some moderate level of validation I get from banks making the outrageously poor business decision to give me new credit cards. I work hard to embody the definition of “credit card gamer” in my being. Few have or will ever make money from my business. And yet somehow, five new cards came my way in 2025.

- TD Bank Business Solutions Credit Card (May)

- Mesa Homeowners Card (May)

- Bank of America Business Atmos (August)

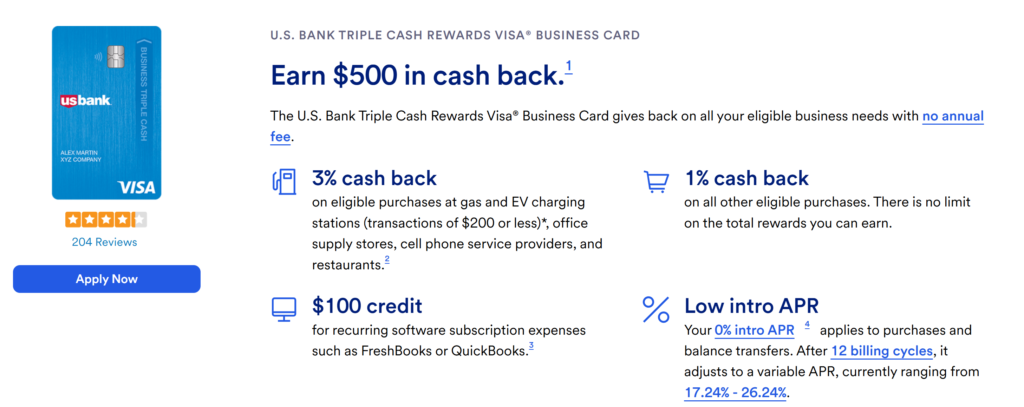

- US Bank Triple Cash Business (August)

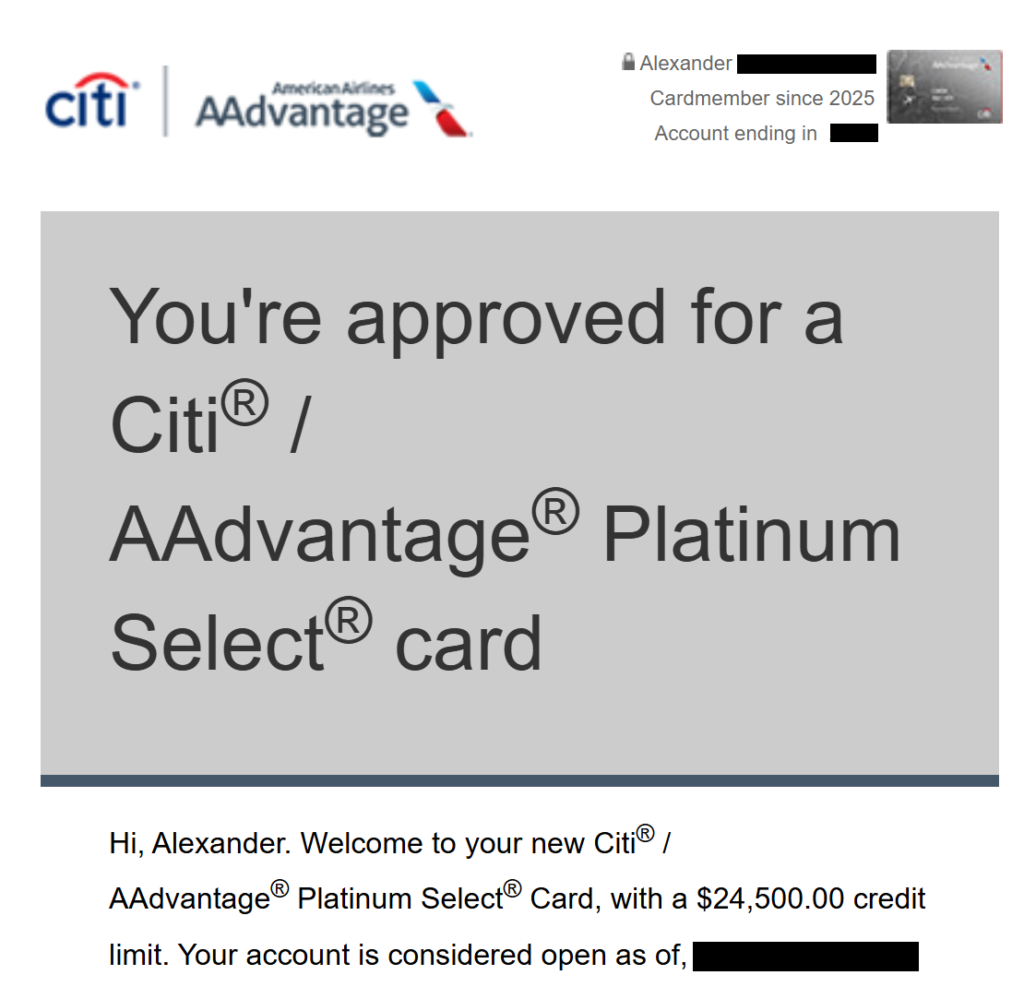

- Citi AAdvantage Platinum Select (October)

Each of these cards I opened up with a specific objective and reason, either for bonuses or ongoing use or some perk I wanted.

You may also notice something of a recurring theme here. Three of five cards above are Business cards. There are really two driving factors here for me: 1) There are some really, really good offers for business cards, 2) Generally (but not always) Business cards do not report to Consumer bureaus, “hiding” activity from other issuers.

What did these get me?

TD Bank Business – The truth is, I had so many issues getting, activating, and completing spend on this account, that I not only missed the $400 sign-up bonus, but I actually missed a payment, causing all sorts of other hassle. Live and learn, but I’ll be back for TD bank in 2026.

Mesa Homeowners – 50,000 point sign-up bonus ($500 value), plus a wide range of other perks I took advantage of ($25 quarterly Lowes credit, $100 gift card for Cozy Earth, etc.) All was well until they shut the card down after they ran out of money (or perhaps determined their product was in fact highly unprofitable and wholly unsustainable…)

Bank of America Atmos – 80,000 mile sign-up bonus AND a $99 companion pass. I’ve booked 2 round trip tickets to Europe on this in 2026, and we’ve got a 10-year anniversary trip to Hawaii with one of the tickets that companion pass. What a deal.

US Bank Triple Cash – $500 sign-up bonus AND 0% APR for 12 month. I put my bike-crash replacement bike on here, banked that sweet discount, and am paying of fully in 2026 (take advantage of borrowing money for free!)

Citi AAdvantage Platinum Select – 80,000 mile sign-up bonus and free bags for domestic flights. AA has some STEAL discount fares (I’m flying to CA for 6k points in October!), so both the big points bonus and the bags is a great combo. Cannot recommend this enough.

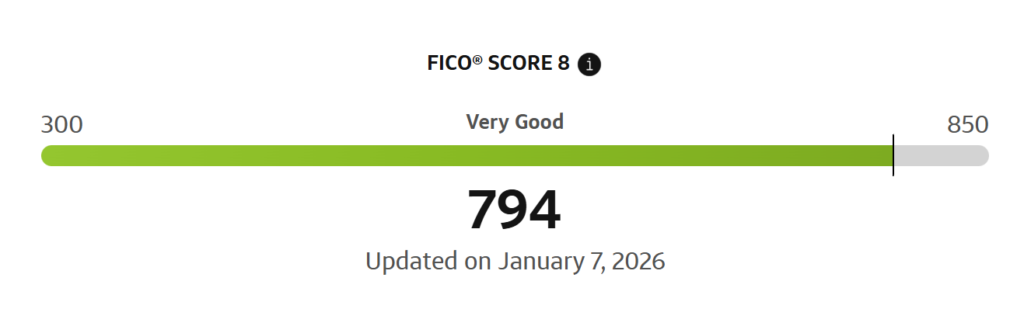

Doesn’t all that activity hurt my credit score?

The truth is, largely no. Most issuers use only one of three bureaus, so there aren’t as many inquiries as one would think. New accounts do reduce the average age of trades, but I have so many open accounts that even five new accounts doesn’t meaningfully drop that. Generally these new accounts do not mean an increase in revolving debt (although I do love a good 0% promotional rate), so no meaningful rise in risk. I also make my payments on time, so nothing adverse there. The kicker here is that multiple of these don’t even appear on my personal bureau.

What can I expect in 2026?

I’ve made it a week into the new year and haven’t applied for any new cards. Somehow last year I made it five months. If I were to put money on it, I’d say I’ll probably open another 5 new cards in 2026. There’s nothing sweeter than that juicy new account sign up bonus.

Obligatory post-ending gif.