I love being targeted for good deals. This hits the mark spot on, even if it does require a bit of finagling to make it work. So here goes.

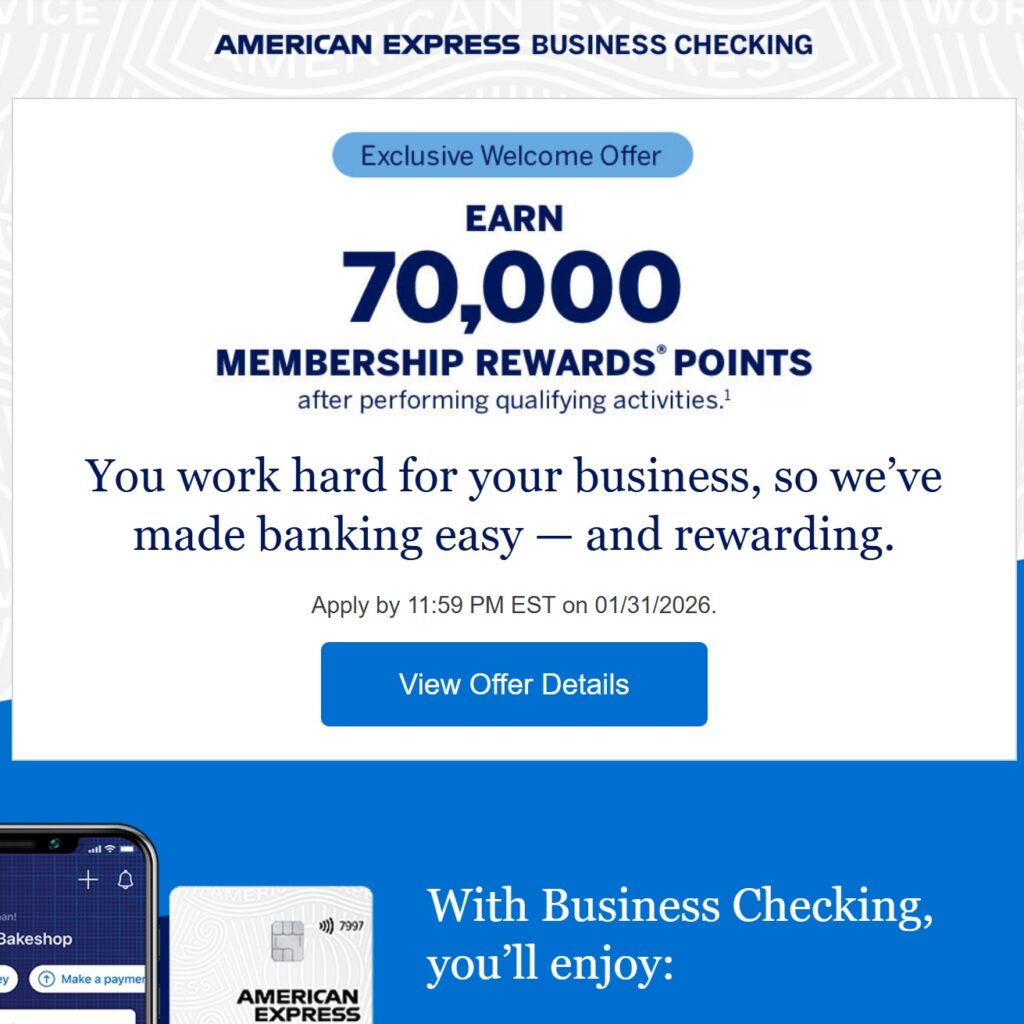

70k American Express Membership Rewards points for…

1) Opening a Business Checking Account

2) Funding with $15,000+ (within 30 days)

3) Maintaining $15,000+ average balance for 60 days from funding

4) Completing 5 qualifying transactions within 60 days of opening

After a bit of scheming and thought, I pulled the trigger this weekend and decided to do it. But even that is a bit unconventional, so let me break it down.

First – For me, the offer is valuable.

70k points is a good bonus. Substantially higher than the 30k public offer for this account. Historically I have found I see ~1.5 cents per point, so this 70k bonus is worth ~$1,050 in value. This is because the transfer options for AMEX are pretty compelling, and occasionally there are good promotions and redemption options at various partners.

Beyond the points themselves, the balances I hold here temporarily will earn 1.3% APY. This means I’ll earn approximately…

– 1.3% APY / 12 = 0.11% APY/month, or 0.22% APY for the 2 months I have to hold balance

– $18k average balance x 0.0022 = ~$40 in interest

Because there are no fees or costs for the account itself, so even if I end after receiving this bonus, I’ll be up $1,050 from the points and $40 in interest.

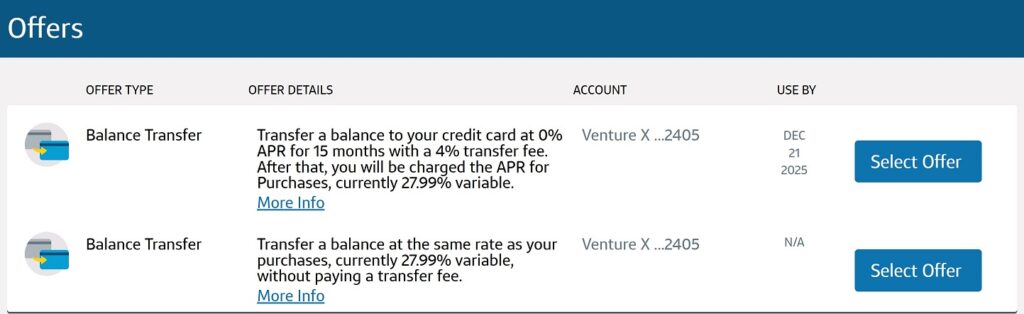

Second – I can be a bit schemey on the funding side, to effectively borrow the deposit at no cost

I typically don’t go around with $15k in cash/checking balances. But I do have a few options to borrow that temporarily for low or no cost.

– HELOC draw – This costs 8.5% annually, so would eat into the value. As a backup, good option.

– Capital One purchase rate BT – Currently I have a 0% transfer fee, but also a high ~20% APR, unless I pay in full before the payment is due. Because this posts to purchase rate, there is grace period/float (which is atypical for balance transfers).

I waited until the day after my statement cycled, and then initiated a $22,500 BT check to myself, which I’ll immediately deposit in the business checking account. That will give me ~50 day where I will sit on the deposited funds in the AMEX account. I will then use that $22,500 to pay the balance in full before the next statement due date.

– C1 account statement cycle on November 6

– Draw $22,500 from C1 account with no-fee purchase check on November 7

– Deposit $22,500 to AMEX account on November 14 (assuming this will take a week to arrive)

– C1 account statement cycle on December 7 with $22,500 balance due January 1

– Pay from AMEX checking to C1 account on December 31 with $22,500, $0 remaining balance

Average balance without any other transfers here for the 60-days after funding with $15k ($22,500) will be:

– 47 days @ $22,500

– 13 days @ $0

– 60 days average @ $18,000

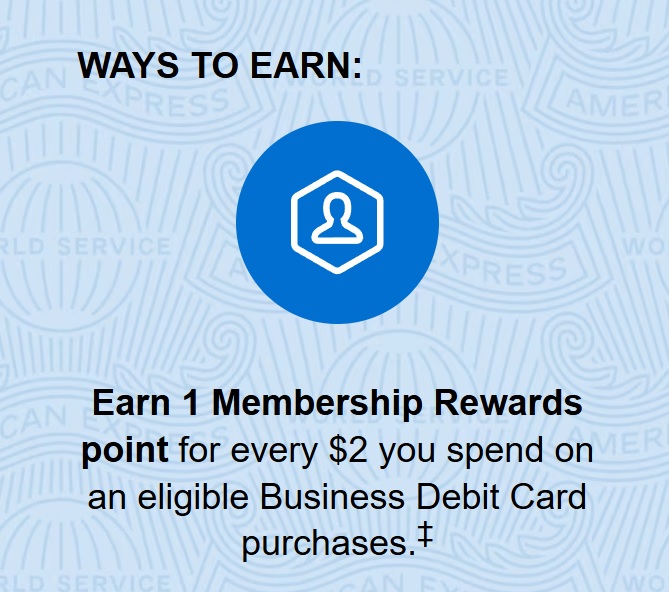

Third – I’m interested in the debit card rewards

There are a few bills I cannot pay by credit card, but I do have the option to pay by debit. If I have the possibility of earning points with this, then that could be make this account outrageously valuable. Some terms in the T&C suggest I may earn nothing, but if I’ve learned anything from my schemey activities, it’s to test things yourself.

I’ve pulled the trigger and I’m doing it. Account is opened and check is on the way. Inevitably this is going to be harder than I’m hoping, but hoping there’s not some long deposit hold or other delay preventing this from working. We’ll see.