I may have a dozen cards with annual fees, but that doesn’t mean I like paying the fees out of the goodness of my heart. There’s some sort of, typically meaningfully, benefit I see with each of those cards. Free nights. Free bags. Travel credits. Uber discounts. Regardless, big fees, though, are still potentially scary and off-putting.

Cue American Express Platinum. $895. EIGHT HUNDRED NINETY FIVE DOLLARS! That’s $2.45 a day. Ten cents an hour every hour of the year. What kind of value do you get for that? Well the truth is, if you’re good at optimizer, quite a lot. Listing the benefits I personally see the most value from (there are many more):

- Annual Airline Fee Credit – $200/yr – So easy, I literally use this for United Flight “Travel Bank” credits.

- Digital Entertainment Credit – $300/yr ($25/mo) – WSJ subscription & Paramount + for free. What’s not to like?

- Uber Credit + UberOne for free – $200/yr ($15/mo + $20 in December) – With free UberOne, this is a free lunch once a month. I get UberOne for free elsewhere already, so just value this at $200.

- (New 2025) Lululemon – $300/yr ($75/quarter) – I won’t lie, the sweatpants I got at Lululemon for free are literally the best thing I own.

- (New 2025) Resy Credit – $400/yr ($100/quarter) at any Resy Restaurant (given we like to eat out, and some of our favorite local restaurants are Resy, this is easy)

- (Improved 2025) Hotel Credit – $600/yr ($300/6mo) at “Fine” or “Hotel Collection” hotels (this can be good, but often the hotels are so ultra premium it’s not worth the discount)

- + So, so many more

You can do some basic addition. If you add the ones I care up about alone, if I take advantage of all of them perfectly, that’s $2,000 alone. Now, I’m imperfect. I also don’t find pre-paying for something necessarily worth it, but I’m getting AT LEAST $500 in value on top of that annual fee.

The point of this post is not intended as hoorah go get an AMEX Platinum card (maybe you shouldn’t!) It’s also not “these are all the amazing benefits” (there are some pretty good ones!) But rather to focus on the $600 hotel credit alone. This past month I took advantage of that credit, and I think that’s a great highlight of that potential benefit.

American Express is perceived as a luxury brand, and one of the offerings they have is their Travel services. Bookings, points redemptions, extra perks, all the goodies. I’ll be honest and say it’s fine, but you often can get a better deal by shopping around and using other vendors or booking directly.

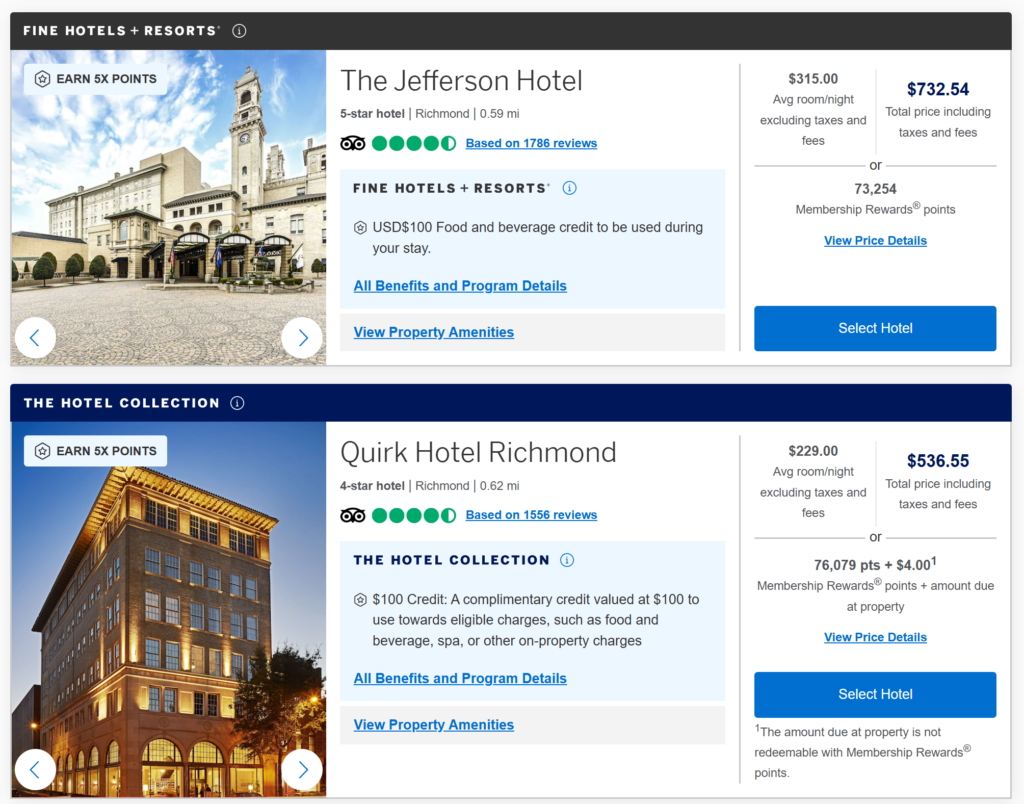

Except there’s this beautiful, sometimes pretty amazing $300 hotel credit. This was previously annually ($300 x 1 per year), and now they’ve bumped it up to the first and second half of the year ($300 x 2 per year.) If you can get a discount on a planned stay or an improved accommodations, that could be pretty worthwhile. The reality is that while there are LOTS of hotels eligible (1,800+ across the world), many of those are truly ultra-premium ($1k+/night). But there are some gems. Looking in the Richmond, VA area, we have the Jefferson & the Quirk, both of which are delightful hotels.

This presents the opportunity for either a heavily discounted stay, or potentially one that’s entirely “free”, paid for by the credit. In future instances where we don’t have a stay where these benefits can be used, we 100% are going to use this for a stay-local ultra-premium visit. There are some tertiary benefits, too. Both the Jefferson and Quirk, for example, offer a $100 hotel credit for food & drink.

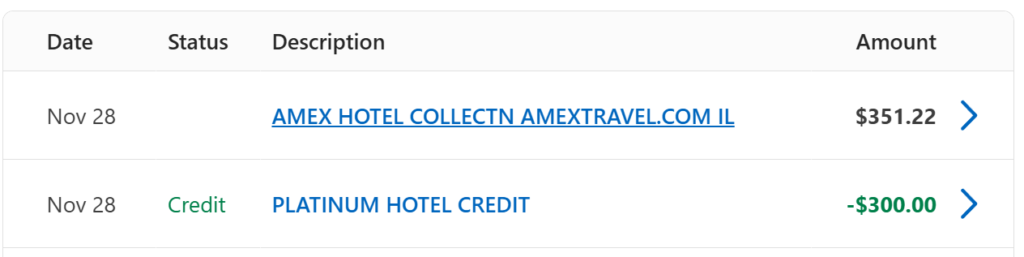

The reality is that we have an actual planned vacation where this benefit fits in well. We’re visiting Newport, RI in June, and there is a Fine Hotels + Resorts hotel there where we’re getting $300 off our $351.22, 2-night stay. On top of that, we’re getting a $100 credit for food/spa. Who am I to argue with that?! We’re adding additional days at the same hotel (at a better, non-AMEX travel rate), but taking advantage of this benefit helped shave the total cost for hotels down by almost half!

Does this alone make the card worth it? No, but it certainly adds an interesting benefit worth considering. And if you’ve got the card, absolutely take advantage of it, even if it’s a Staycation type getaway.