Why leave money on the table when paying the pesky utility bill? Everyone uses some combination of electricity, gas, water, and trash. For more than five years, I’ve had the luxury of a very healthy 5% discount on utilities simply for using my US Bank Cash+ card. This has added up to many, many hundreds (thousands?) of cash back (looking at the last year alone, I redeemed $154.11!)

What is this magic?

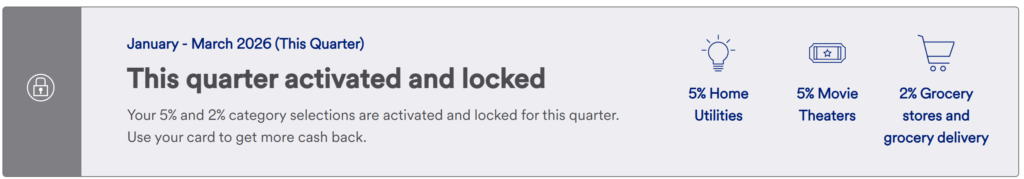

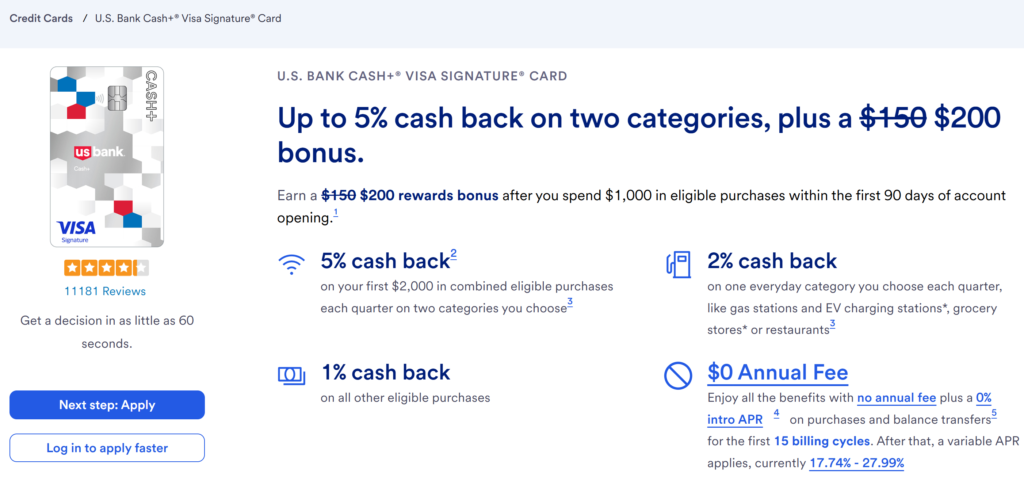

The US Bank Cash+ card is it. While the product itself is slightly more complicated, as you get to select your preferred bonus categories for 5% and 2% category bonus. There are a range of categories of various usefulness. Utilities has been a staple for as long as I have been a cardholder. While there is a cap of $100 on quarterly bonus 5% spend ($2,000 category spend), I have not found this to be an issue as our utilities are typically well under this threshold. Redemption is easy, with the only meaningful limitation as a minimum redemption threshold of $25.

What’s the scheme?

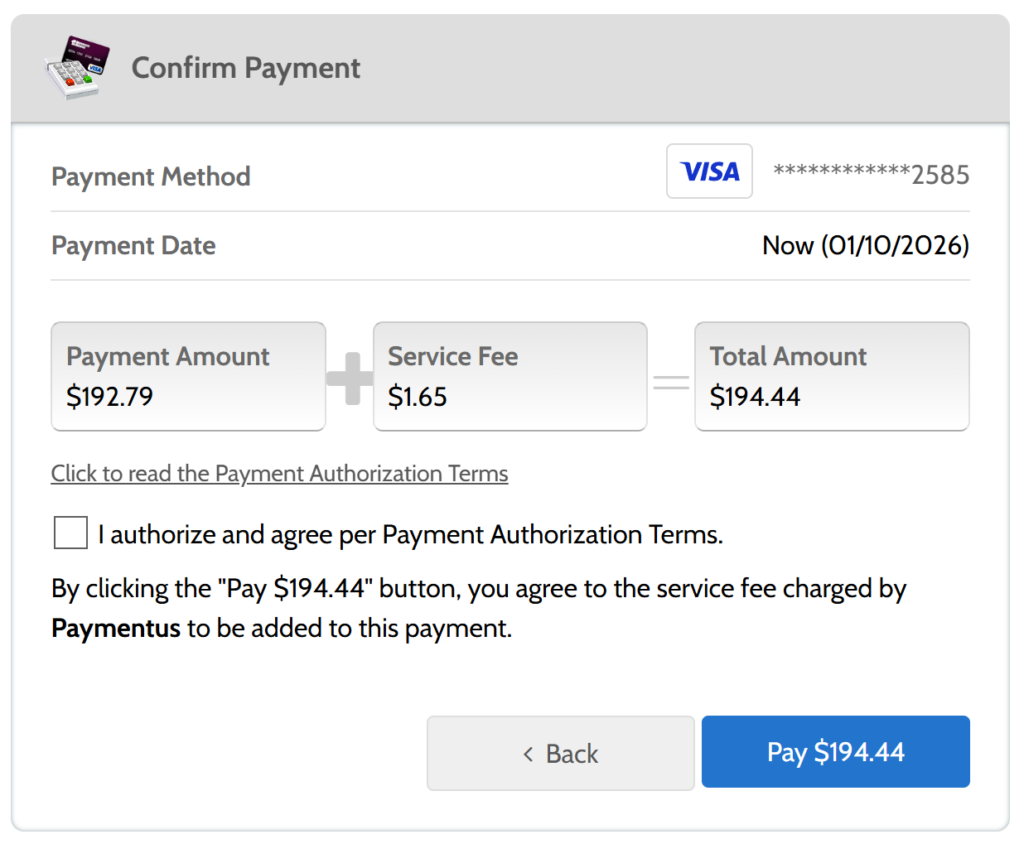

Simple. Pay with a card. Bank the 5% rewards. Often there are some nominal fees when paying utilities with a card (Dominion Energy, for example, charges $1.65 per payment). Typically I pre-pay utilities for a month or two, with the aim of minimizing the added transaction fees. Sometimes if the bill is small enough I even pay a late fee just to delay making a larger payment.

The math is simple. Excluding any transaction fees, spend $500, earn 5% back ($500 x 5%=$25). Because this is redeemed for cash’s back, that means you effectively pay $475 (you can redeem after the statement cycles for a statement credit) for $500 of utilities ($25 / $475 paid = 5.26% net rewards on spend). Pretty darn solid.

If you’re interested in this for yourself, US Bank is offering a $200 signup bonus for spending $1,000 in 90 days. I won’t even go into the “you pick a second 5% category” or the 15-month 0% Purchase Rate APR (if you park the money in a high yield savings account, that’s like earning the rewards twice!) Link here.