Once upon a time, Fidelity had a $100 bonus for opening an individual personal investing account and funding with $500. In late 2022, I took advantage of this, and funded a total of $1,000 ($500 in December’22, $500 in January’23). I parked almost all of this money in a S&P500 index fund (IVV) and did nothing other than reinvest dividends & track the balance monthly. The truth is, the past three years have seen pretty stellar market gains. This one-time investment highlights exactly that.

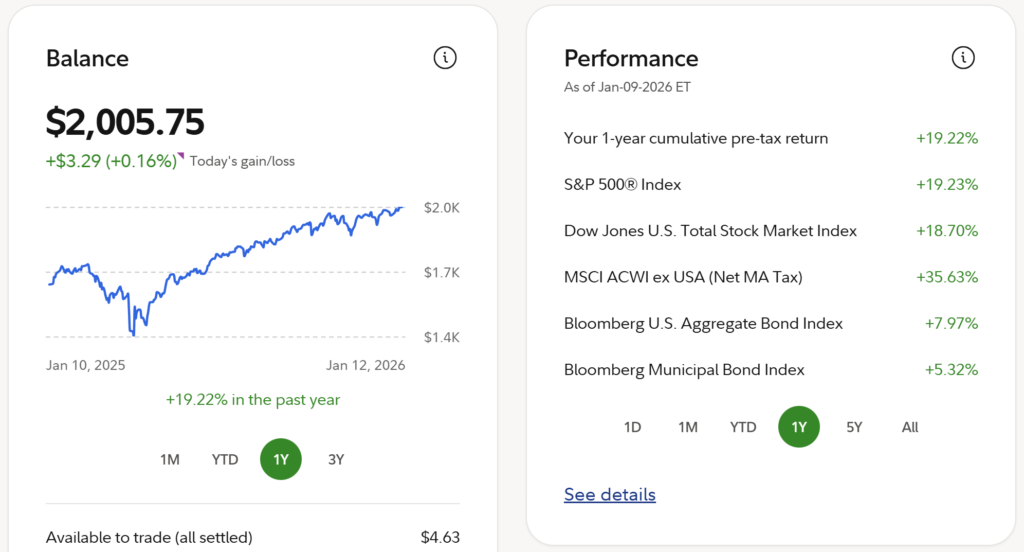

Total value today: $2,005.75 ($4.63 in cash, $2,001.12 in IVV)

Total invested: $1,000

Total promotional value: $100 (thanks Fidelity) – 10% of original investment

Total investment gains: $905.75 (thanks 2023, 2024, 2025 markets) – 90% of original investment

As I note above, performance the past three years has been notably higher (~20%/year) than historical average (~10%). But looking at it by year is pretty great perspective, too.

2022 – ($13.06) investment gain (no dividends)

2023 – $250.26 investment gain incl. $20.63 dividends

2024 – $332.55 investment gain incl. $21.69 dividends

2025 – $297.91 investment gain incl. $23.01 dividends

2026 (YTD as of 1/12) – $38.09 investment gain (no dividends yet)

While the returns (rate) here feel pretty obscene, it’s a great highlight for why investing is so critical. And also how outrageously simple and hands off it can be. Now the reality is that I’ve paid some nominal taxes on the ~$65 in dividends I’ve received over the past three years, but the “just invest and it pays dividends” ethos holds true regardless of the fact that I haven’t quite actually doubled my money.

My key takeaways

- Only two of my five investment accounts last year outperformed the S&P500, one of which highly nominally. I would have been better off if I just kept 100% of my investments in low-fee index investments.

- The best investment strategy is just be saving money. If I had thrown even $250 a month into this account over the past three years, I’d have seen a ~50% increase in the value of those contributions.

- Dividends have a great way of growing and compounding. The yield (return %) over those three years has actually dropped, but the total payments continue to rise. In ten years this will be only more true.

Obligatory post-ending gif