…but there’s always more to the story. I’ll keep this focused on the the cap, and avoid the challenges associated with the…politicization at play. If the question were around affordability and predatory industry behavior, there would be a wide range of other administration focus, like…not gutting the CFPB. With that said, let’s get into it.

What is the proposal at play?

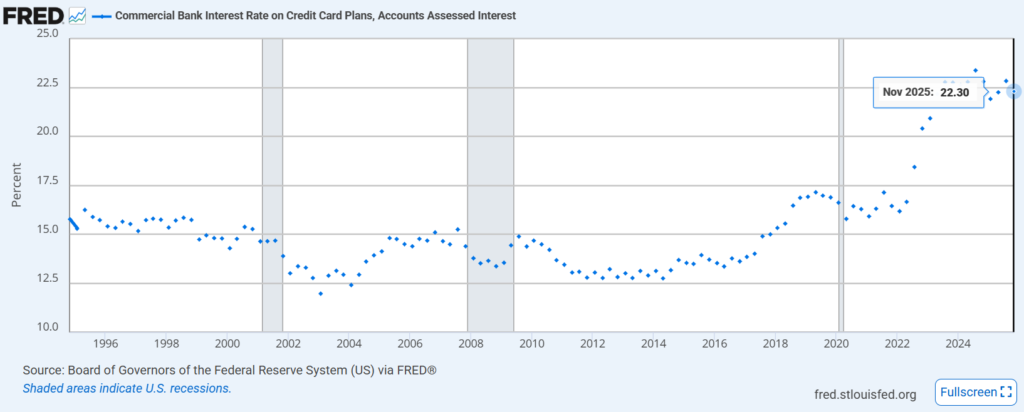

12-month 10% cap in interest rates (APR) of all credit cards. This is potentially big. This represents a 55% reduction in interest rates, per Federal Reserve, of average card interest rates of 22.3% in November’25. Desired to be effective as of January 20 (one week from today).

Is this the first time we’ve heard this message?

Absolutely not. There have been bills in the House and Senate as well as been big campaign claims. What there hasn’t been is any actual traction within either party to seriously champion this effort. Shamelessly stealing from Senator Warren, “I said a year ago if Trump was serious I’d work to pass a bill to cap rates. Since then, he’s done nothing but try to shut down the CFPB.”

Why is this actually so much more complicated than capping fees?

APRs vary greatly across products. There are new card offerings with APRs as low as 7.49% (see Aven) and products as high as 36% (see First Premier). Even within any product, APRs vary greatly (see Capital One VentureOne where APR varies between 18.49% and 28.49%.) Even within any one bank APRs often range greatly across products. The reason here is not as simple as corporate greed. Card pricing (ex. APR) and card terms (ex. credit limit) are highly risk based. This is true for auto loans. This is true for mortgages. This is absolutely true for credit cards. This article from Equifax is a decent writeup.

What this means is that some portion of folks with interest rates above 10% are priced at those rates BECAUSE the risk level associated with lending to these populations requires that level of pricing to allow lending for that population at all. If pricing were radically cut and banks were to lose money at new levels, lending would also be cut. Only the lowest risk populations would remain eligible for credit (read: risky populations would be increasingly declined). Banks would substantially shift product design to ensure bank profitability remains (read: other terms like annual fees are likely to be substantially increased.)

My take here is nothing good comes of this

If this becomes effective, you would immediately see a sharp pairing in extension of NEW credit (read: 50%+ reduction in approvals for new cards), a substantial cut in existing credit (read: mass account closures & large in credit lines), as well as substantial shift in overall product design to make up for lost bank revenue (read: higher annual fees, line increase fees, more friction in autopay to increase fee revenue, etc.)

I am absolutely for effective oversight of banks and ensuring predatory behavior is limited (I am in fact a fan of the CFPB!) I also absolutely do think high APRs are one (of many) signs of highly predatory behavior. Approaching this with highly deliberate design is critical to developing effective, sustained policy. As it is designed now, a 10% APR cap for one year would absolutely save existing borrowers many tens of billions of dollars over a one year duration. Unsurprisingly, it also would accomplish nothing beyond that.

Obligatory post-ending gif