Anyone who knows me also knows that my most passionate hobby after credit card gaming is cycling. I like riding fast. I like long rides. I like meandering around the neighborhood. Occasionally I like making funny images out of my routes. I also like riding nice bikes. I’ve lusted after a new racing bike for years, and FINALLY pulled the trigger this past summer on a beautiful, sleek, super fast, and now also dead Canyon Speedmax CFR.

This is part one in a four-post series on my experience buying, crashing, and replacing that big purchase.

- The Purchase – Buy Now Pay Later (this post)

- Homeowners Insurance Claim Coverage

- Visa Purchase Protection

- Merchant Crash Replacement Coverage

To give a bit of a spoiler on the experience here, I had a bad bike crash on this bike, and so it lived a very active, and also very short life. Many months later, I’m no worse for wear (and in fact, part bionic, so maybe even stronger?!)

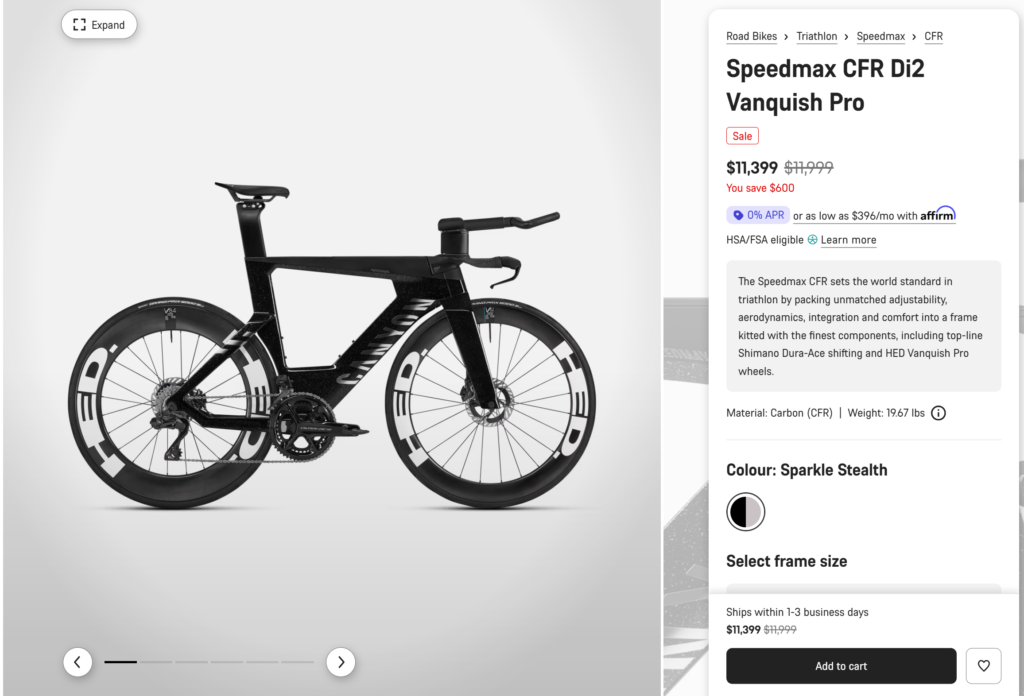

The bike I had long longed for was a highly sleek aerodynamic triathlon bike

After having ridden a very nice Cannondale Slice Tri bike for over a decade (purchased in 2013), I wanted some stylish new technology, fancy wheels, and a fresh look. The Sparkle Stealth Canyon Speedmax CFR was all that I wanted and more. New, undiscounted price of $11,399, it’s an outrageous purchase worth more than two of the three cars in our household. The only things I’ve bought more expensive are homes and cars. I must have opened the website a hundred times over the past three years, and added it to my cart at least a half dozen times

Eventually, the right offer came around…

Unsurprisingly I like a good deal. I’m often willing to inconvenience myself and wait outrageous amount of time for that. This time that paid off.

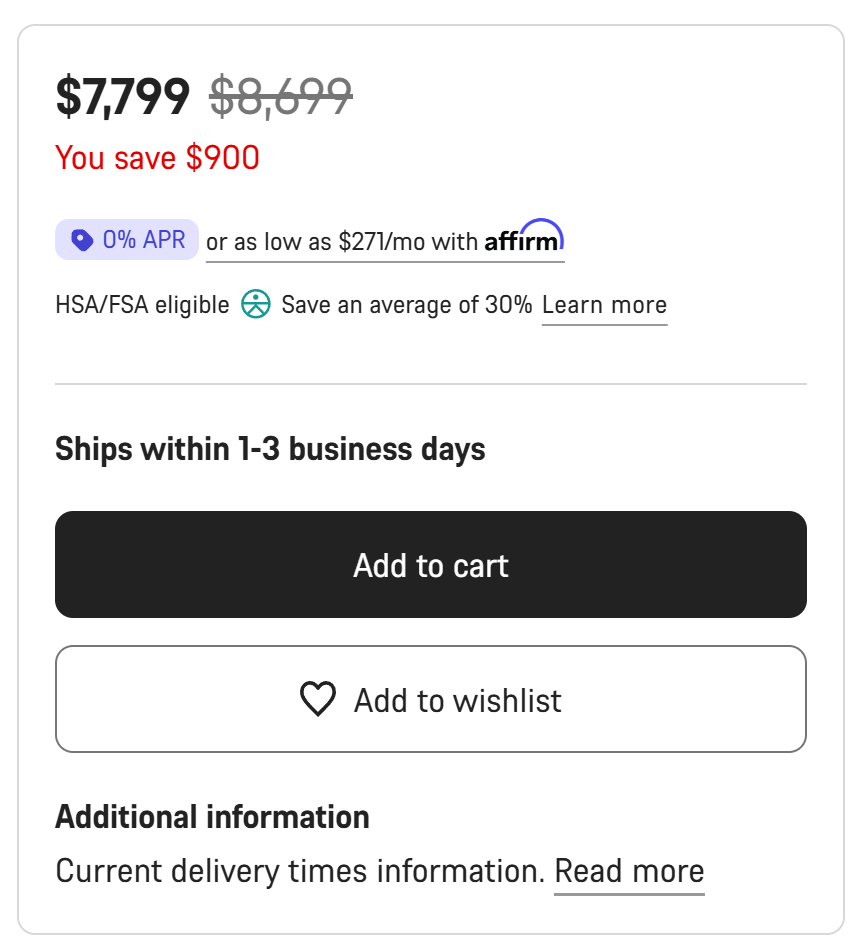

Canyon has an “Outlet”, which is code for “Returned – Like New” or “New – Minor Defect”. I had added one of these to my cart seriously considering sale, and left it there. Canyon targeted me with an extra sale for purchasing from the outlet. An extra 15% off for purchasing the slightly-discounted, minor-defect, brand-new bike?! Free shipping, too?! Well, that makes a big difference. I’m sold.

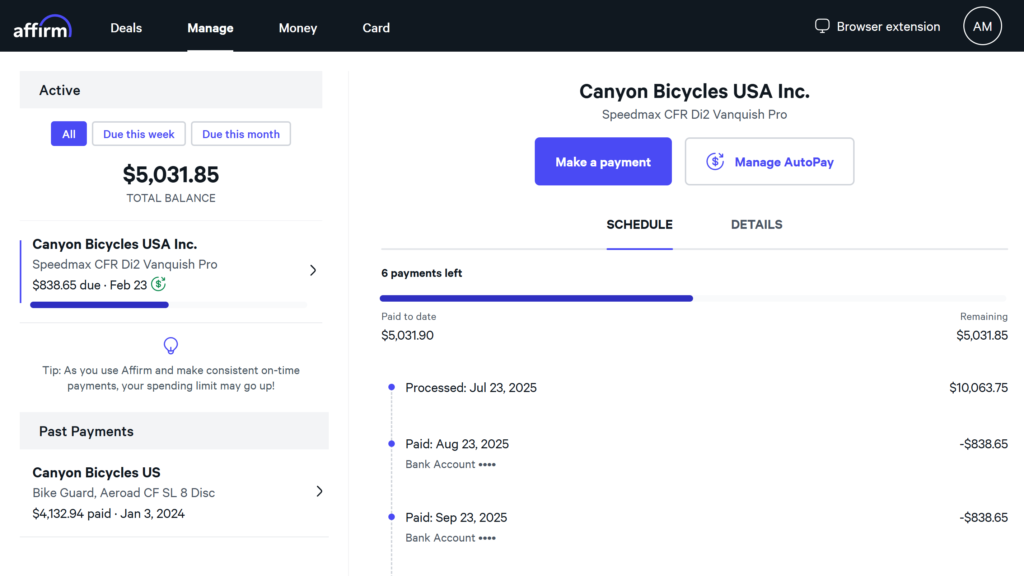

Ready to pull the trigger, Canyon really wants to close the deal (by offering Buy Now Pay Later!)

I’ve planned for this purchase for some time, and had the money to pay for it. But it’s a big chunk to see withdrawn from your bank account all at once. To help stomach that big purchase, Canyon partners with Affirm for Buy Now Pay Later (BNPL). This allows customers to use Affirm in lieu of a credit card, and to secure preferential terms as a result. Canyon does this to drive sales for shoppers who otherwise may be unwilling or unable to complete the transaction. Affirm does this because, in return for credit risk of non-payment, they get a non-nominal fee from merchants (3-6%!)

BNPL has a fair share of drawbacks

- No rewards on transaction, means I missed out on at least 2% in rewards on the purchase (that’s HUNDREDS of dollars on a transaction this size!)

- Using a credit card comes with a range of protections, like purchase protection, refund benefits, etc.

- Affirm is an installment loan, and it is a unique trade reported on my bureau (this is still credit)

- By nature of installment loan, there is much less flexibility for payments than using a credit card (ex. minimum payment is substantially higher)

It was worth it, for me.

I have found that free float (0% interest rate) for large purchases is extremely helpful, and that I value the cash flow flexibility that affords for repayment. Sure, I had the money in the bank to pay off, but why wouldn’t I want that money earning interest instead? There is peace of mind of having the cash on hand, particularly in the instance of something else happening.

Original price: $12,083

Final price: $10,064 at 0% via Affirm for $838.65 a month for 12 months.

And in a few short days, a beautiful box arrived in via specialized FedEx freight delivery. Stay tuned for what comes next.