While typically you’ll hear stories of the big, bad, evil insurance companies denying claims (which I have no doubt is true) this is about the opposite end of the spectrum. Insurance can and does offer some marvelous protection, occasionally in ways wholly unexpected and highly favorable to the insured. Cue my bike crash in August 2025. Brand new, quite expensive bike. Very damaged impacted vehicle. USAA covered 100% of the property damage to other parties, and the full purchase price of my new bike else $2,000 deductible.

This is part two in a four-post series on my experience buying, crashing, and replacing that big purchase.

- The Purchase – Buy Now Pay Later

- Homeowners Insurance Claim Coverage (this post)

- Visa Purchase Protection

- Merchant Crash Replacement Coverage

Homeowners insurance is a remarkably versatile set of coverage

The vast majority of folks avoid any claims on homeowners policies in any year (according to Insurance Information Institute, the claim rate is ~5.3% of policyholders in 2023.) With limited usage, it’s likely that folks don’t even have a clear understanding of what their coverage is. Even in my own claim instance, it was only after contacting the insurance company and filing a claim that I discovered I had coverage for both my own loss as well as property damage to others.

This page from USAA highlighting some of the ins and outs of insurance. I won’t pretend to be an expert, suffice to say that coverage extends far beyond direct damage to your home, at your home, for property in your home. Homeowners insurance covers a wide variety of damage to your personal property even outside your home, theft from your property, and so much more.

The accident itself

I won’t belabor the experience, but will leave it at I had a bad bike crash. That was with a parked car, and resulted in me being thrown face first into the back windshield, getting knocked out/breaking my left tibia, and my bike being thoroughly trashed. Moderate physical damage to me, the bike, and the car. You can see that perfect face-sized crater.

Insurance coverage was highly comprehensive

There were three things materially damaged in this accident:

- Human body (my face, leg, and general roadrash)

- Bicycle (broken wheel, fork, damaged frame, and general roadrash)

- Car (damaged bumper, trunk/panel, broken rear windshield)

Human Body – Perhaps unsurprisingly, homeowners insurance did not cover my own body’s physical damage. If I injured another party, though, there is coverage that may be applicable. My personal medical insurance covers these medical costs, after associated deductible ($4,000).

Bicycle – Much to my surprise, homeowners insurance treated this as a personal property loss from a covered incident, despite the incident happening away from my home. Under my policy the associated “other covered perils” deductible, or $2,000. I expected my bike was a total loss, and that I would be out the ~$10k purchase price.

Car – Also much to my surprise, homeowners insurance treated this as a fully covered, no-deductible coverage. Candidly, I’m not sure exactly what part of my policy this was treated under, but despite being the reasonably liable party I played no part in making the impacted party (car owner) whole. My only claim to fame here is the car was totaled, as the repair cost was apparently too high to be worthwhile. I expected I was liable for damage I caused, and that I would be out thousands for repair cost.

The claim experience with USAA

Such a painless experience, this alone has me recommending USAA for all banking and insurance needs. I called the claim hotline, was immediately connected with an agent who helped process kicking off the process. I shared basic information on the accident, the contact information for the vehicle owner, and after I was out of the hospital a repair quote for my bicycle.

Within a week of submitting documentation (photos of damage, original purchase receipt for the bike, and a repair quote from my local bike shop) I had a bank transfer from USAA for over $8,000 (!!!) USAA covered 100% of the purchase price of the bike, else $2,000 deductible. They also covered 100% of the repair quote cost from the local bike shop. If I were really smart about this, I would have included the bicycle helmet and bike pedals, for a few hundred bucks, too.

I do not know the detailed experience of the vehicle owner, but after about a month I was contacted by the claim agent to say the vehicle was totaled, and that payment was made for the full value of the vehicle to the owner. No other contact or engagement with the owner was required on my part. For what is a highly painful accident, this was the most painless part of the experience.

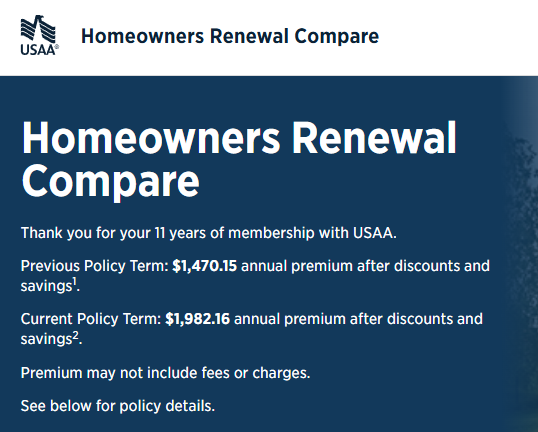

Impact on insurance renewal rates was not nominal

That claim paid out well over $10,000 (between the bike and the car). I reasonably expected this claim to result in homeowners insurance to rise. Our prior annual coverage cost was $1,470.15, and our first post-claim renewal cost is $1,982.16. This is an increase of $512.01, or ~35%. Given overall insurance rates rose ~9% over the past year (much higher than inflation overall), I’ll be honest in saying I expected this increase resultant from a meaningful claim to result in a larger increase. I’ll consider myself lucky.

The real takeaway here is to have the right coverage, and don’t be afraid to file a claim!