We’re a month into the new year and the new credit card itch is starting to scratch. I’m hungering for those sweet, sweet sign up bonuses. And best of all, I know I have some big expenses coming up (tax season, oof!) so hitting them will be easy. Perhaps, even, there’s a long term 0% promotion so I can park some cash in a high yield savings and literally bank it.

My general strategy

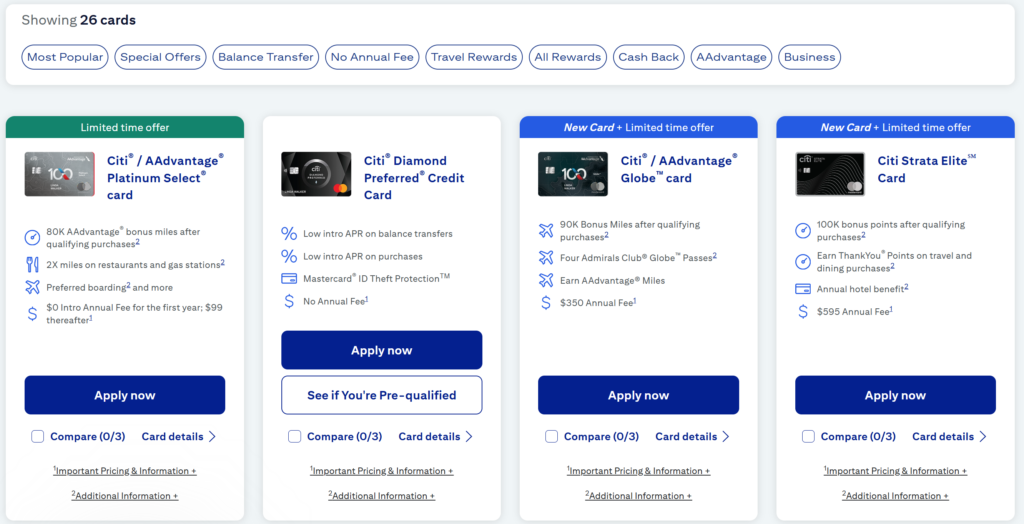

- Go shopping – Don’t jump at the first offer out there, hunt around for what the best deals and promotions are before pulling the trigger!

- Consider both Consumer and Small Business cards – Small Business cards typically are invisible on the bureau, helpful to not show too much new credit and minimize any balances if taking advantage of 0% promotions)

- Use Preapproval to see what will be approved – I like certainty, and this helps formulate a plan that can be executed without a surprise decline.

- Make sure one can take advantage of any sign up bonuses fully – The goal isn’t go into debt or spend money that wouldn’t already be spent. That means not signing up for 15 cards at a time, or immense spending requirements that aren’t actually doable.

- Apply for multiple products at the same time – I like to be approved. This helps make sure that later applications are blind to the earlier ones (same day within seconds.)

What’s piquing my interest

I haven’t been wildly inspired by anything new these past few months, but I have seen a few things that look interesting, including…

1) New suite of Bilt cards that have insane complexity in rewards program

2) Truist Small Business card with a $1,000 sign-up bonus (!!!)

3) I’ve been interested in trying Navy Federal / Pen Federal, though not sure what product I might be interested in

More cards is better when it means sign up bonuses or other valuable promotions

Obligatory post-ending gif