The card is as dead dead as the dinosaurs. Reddit is blooming with speculation and folks miffed at the quick turn here. The original pitch is solid, but just because something sounds good doesn’t mean it’s a good business.

It is so delightfully coincidental that the redemption from my Mesa-provided $100 gift card for Cozy Earth holiday sweats (+ candle) arrived today. As I write this I’m in Mesa-provided bright-red sweat suit sipping an ice cold diet coke. I’ll reflect nostalgically on the extremely short, simple, and ultimately anticlimactic experience of being a Mesa cardholder.

So what’s the deal with the card and why was it so potentially promising?

- Rewards on your mortgage (I’ll share more on this below, but I’d argue this is the peak “too good to be true” product design

- Some great major merchant credits/discounts

- Unique enhanced category earn (3x on taxes, daycare, insurance, amongst others!)

- Decent sign up bonus ($500)

- Transfer options to various airlines/partners

Mortgage rewards, what?

Exactly what it sounds like. Can’t put your mortgage on the card? No problem, you still get one point per dollar of your mortgage payment (principal, interest, and taxes/insurance). This did require active spend on the card of $1,000 a month to trigger, but…

$1,000 spend earning 3x at select merchants (notably taxes/insurance, which are easy to prepay) = 3,000 points

$2,000 mortgage earning 1x with no spend = 2,000 points

Combined = 5,000 points on $1,000 spend, or 5x in points, which I’d found to be worth ~1.25c each

Where this gets sweet is for folks with big mortgages or large payments. 10k mortgage? 10k points/month for the same $1k spend requirement. Not something that’s going to make you rich, but certainly could offset big mortgages in a meaningful way.

Merchant freebies abound

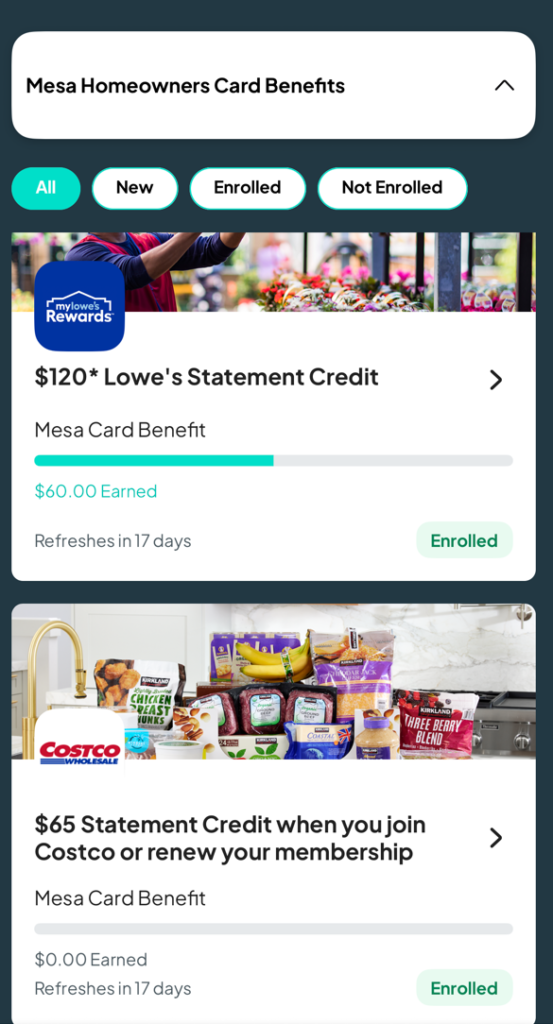

$120/year at Lowes ($30/quarter). As simple as using the card in store or online, near-instant credit back. Still earn points on the purchase.

$65/year credit at Costco

Instacart + for a year. Looks like this one still works for anyone with a Mesa card (I just signed up moments ago!)

$100/year gift card for Cozy Earth

Also not anything that will make you rich, but once again, nice perks for a no annual fee card.

Enhanced category earn

3x on all Home Related Purchases: Home improvement, Utilities, Home maintenance, Decor & Furniture, Insurance & Taxes, Daycare

There are high earn cards for many (but not all) of these. Really the value is the combination with the mortgage bump. Still going to miss

So now what?

I’m unfortunately sitting on 56,370 points I had valued at $563.70. Most of those are from the card signup (50k), the rest from the mortgage matching. A bit of a disappointment, but despite the assurance in the shutdown email that options would be provided, I’d bank on that ship having sailed. A bit of a loss, but not the end of the world. And hey, maybe I’ll be pleasantly surprised and I’ll see something back for that? If not, I won’t lose any sleep. Lesson is, don’t get to comfortable with the Fintechs. Hold your purse strings tight.