The past few weeks I’ve been targeted for a few Facebook and Instagram ads. I’m a sucker for a deal, and so I like to humor what comes across because occasionally there’s something to take advantage of.

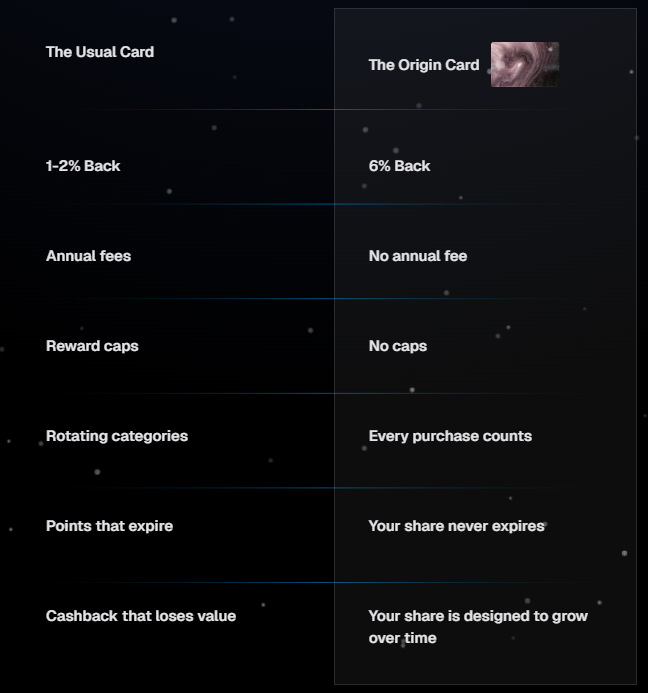

Fancy marketing copy. Bold value claims. Big headlines. However, just because you can make something pretty and make that something appear impressive, doesn’t mean there’s actually anything behind that facade (see Mesa Card & how quickly they came and went!) I’d love to be proven wrong (sign ME up for a 6% everywhere, no gotchas card!) but I think the likelihood here is low.

What’s the claim

“AI is changing the economy fast — and most people won’t share in the upside. Early access ensures your share is secured from the start.” And, don’t you know it, this Debit card offering will be able to offer 6% back, “no fees, no rotating categories, no tricks”, because AI. 6% back everywhere is pretty remarkable. The richest debit cards offer ~1% back on spend. The richest credit cards offer ~3% back on spend (or often 5-6% on categories). 6% is big big big.

Why is this set of pretty and large claims obscene and not financially realistic?

Money money. Absent some outrageously lucrative private transaction data sales, the economics for 6% don’t work. They don’t work in wide, useful categories. They don’t work for broad “spend everything”. The fees for debit card transactions (in the US) is typically below 1%, and the fees for credit card transactions is typically below 3% (although this does vary greatly by category/merchant). See this rate table from Visa (much of this is unintelligible, but the general rate categories and debit/credit don’t show anything over ~3.15%.)

My ultimate take here is to be highly skeptical and not to take everything at face value. Sometimes too good to be true is exactly that, not true.

And of course, the post-ending gif