I don’t like paying fees. I don’t like paying small fees. I ABSOLUTELY don’t love paying big fees. That said, I have found there are many cards where the annual fees are worth the slew of rewards and benefits that come with the membership. American Express Platinum is one of those, despite the outrageous, marketplace-topping $895 headline.

AMEX Platinum does not have meaningful rewards for spend the card itself

The underlying earn for AMEX Platinum is 1x. While there are enhanced earn for spend through AMEX Travel (5x on flights and hotels), the rates being higher typically make that not worthwhile. There is, however, a notable sign up bonus for any new cardholder (currently 175k points) that makes the math a no-brainer for the first year (the value more than offsets the annual fee, alone.)

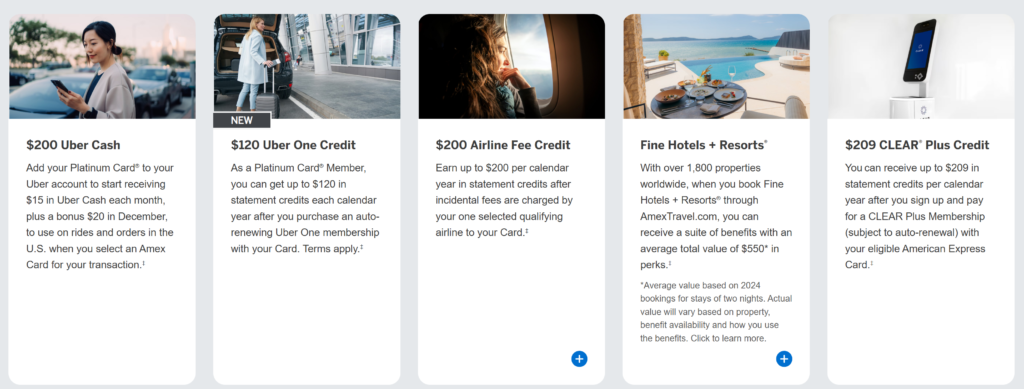

AMEX Platinum offers so, so many credits and discounts (below are those I actually think are worthwhile)

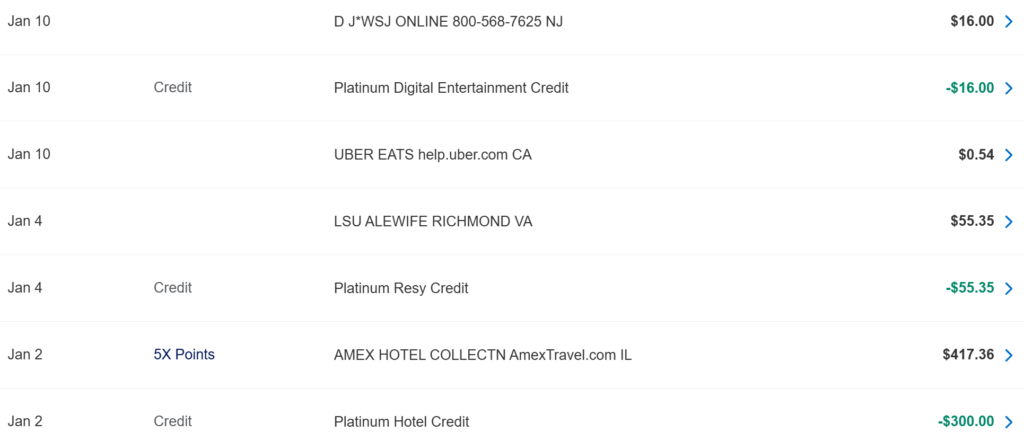

- $400 Resy credit ($100/quarter) – I like good food, and Resy has some of my favorite local restaurants. This will never go to waste. Beyond enrollment, all you do is spend at a Resy restaurant on the card. Easy, painless, good value.

- $200 Airline Fee credit (year) – I love travel. The only thing better than vacation is free vacation. This is a bit more complicated as you have to select your preferred airline, but the reality is it’s quite easy to squeeze every $ out of this. I select United and buy TravelBank credits in $50-$100 increments. Easy money.

- $200 Uber credits +$120 UberOne credit ($15/month + $20 in December) – Once a month I get a highly discounted delivery lunch or when traveling a free/discounted Uber. UberOne for free makes this easy to maximize.

- $300 Digital Entertainment Credit ($25/month) – This one’s a bit funky, but there are a wide range of subscriptions that qualify (personally I do Paramount + and WSJ+). A number of other streaming options count, too. Good value.

- $300 Lululemon credit ($75/quarter) – Quarterly refresh of loungewear stretchy pants? Sign me up!

- $600 Fine Hotels & Resorts Credit ($300 Jan-June, $300 July-Dec) – I’ve only recently started to take advantage of this, but I have found substantial value in providing heavily discounted hotels for travel I’m already planning. Many of the available options are…expensive, but there are some gems, and MANY options.

- Various others which may be worthwhile to some ($100 Saks credit, $209 Clear Plus credit, $155 Walmart+ Credit, etc.) Full details available on the AMEX product page linked above.

AMEX Platinum also comes with some nice perks

- Lounge benefits – AMEX maintains a network of lounges where card ownership grants the primary cardholder unrestricted access (note – there is a spend requirement for free access for additional travelers). After multiple Centurion lounge stays, I’ll say they are quite good, but not the absolute best.

- Rewards transfers partners galore – The only way to spend AMEX Membership Rewards points smartly is by transferring them. Typically I have found this yields 1.5-2 cents of value per point (although I typically do economy flights, not business/first where that value may be greater).

For me the math works out in my favor. My $895 annual fee yields $1,500 in value.

- Resy Credit – This is worth $400 a year to me. I will otherwise spend at least $100 a quarter at a Resy restaurant.

- Airline Fee Credit – This is worth $200 a year to me. I may sit on the credit for a year or two (the perk of the United TravelBank is that you can stack them up!) but I will use them for flights I would otherwise take anyway.

- Uber Credit – This is worth $200 a year to me. I already have UberOne for free through other cards, but the monthly $15 + extra $20 in December was used every month in 2025. Given I work from home typically 2 days a week, I’m always in need of a don’t-cook-lunch-for-myself excuse.

- Digital Entertainment Credit – This is worth $100 a year to me. I do use it monthly for ~$25, but I’d candidly probably skip the subscriptions I’ve got these set up for outright if I were paying full price. But if it’s free…the bar is a bit lower.

- Lululemon Credit – This is worth $300 a year to me. While I don’t NEED the freebie loungewear, I really do like having comfortable clothes, and I’ve used it every quarter since it’s come out.

- Fine Hotels & Resorts Credit – This is worth $300 a year to me. The past few months I’ve taken advantage of $600 worth, but I did not at all in 2024. Now that I’m on my game, perhaps I’ll be able to fully leverage this benefit.

- I absolutely take advantage of other benefits, too, but even absent assuming any value for those, I’ve more than paid back the annual fee from those above, alone.

- $400 + $200 + $200 + $100 + $300 + $300 = $1,500

Am I saying the card is worth it for you to get? Well, maybe (that 175k sign up bonus is pretty hard to beat!) For me, it’s worth keeping around despite the sucker-punch annual fee size.

Obligatory post-ending gif