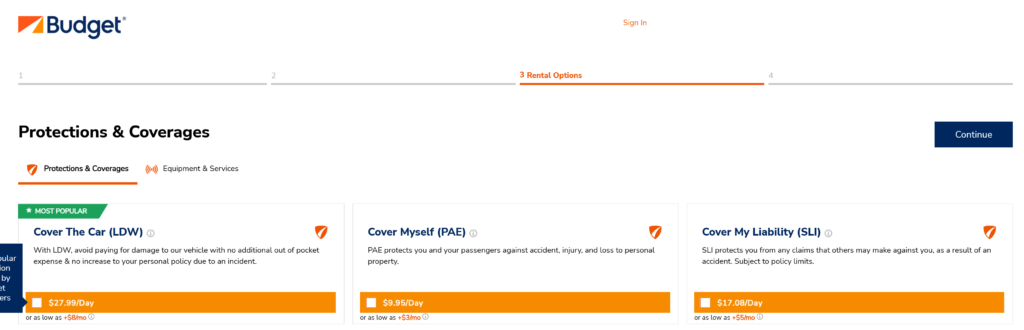

We had a lovely MLK weekend trip up in New York City and Connecticut this past weekend. While we didn’t need (or want) a car in the city itself, we did need one to visit the family in more rural Connecticut. The internet helped find a reasonably cheap booking (<$100 for a one-way, one-day rental), and so Budget it was. But their business model isn’t car rental so much as it is cross-sell insurance and GPS and a thousand other optional, unnecessary add-ons.

With very, very few exceptions, there’s no reason to pay for insurance extras. Here’s why:

- Your primary car insurance already provides you coverage

- Your credit card likely provides Primary or Secondary insurance coverage

Primary Car Insurance – This is only relevant if you have car insurance, and is only relevant for “standard” rentals (ex. rentals of vans, trucks, exotic cars, etc., are potentially ineligible). What it does afford you, though, is your existing coverage with relevant deductibles and coverage limits. If it’s good enough for your owned vehicle, it’s good enough for your rental vehicle.

Credit Card Coverage – Even better than your own insurance covering damage, is insurance that doesn’t have the potential to impact your personal rates and coverage. Cue the credit card you swipe to make a payment for the rental. NOT ALL CARDS OFFER ANY BENEFIT, BUT many do. With Capital One, Venture X this coverage is “primary” (ie. this supersedes your own personal policy) for other cards this coverage is “secondary” (ie. it pays for anything, including deductibles, that your primary coverage does not.) With Chase, their Sapphire Preferred & Reserve cards offers primary coverage, while various other cards (ex. Freedom) offer secondary. I won’t expand for every card/issuer out there, beyond saying there is a very good chance that if you’ve got a credit card in your wallet that offers rewards, you likely have at least secondary coverage.

Skipping Damage Waiver can save you big.

While for our rental, this fee was *only* $27.99 for a day, if you’ve got a multi-day or week long rental, that can add up to hundreds of dollars. Peace of mind for traveling is important, but you get that peace of mind just as well so long as you know what your coverage is either through any existing insurance, or though your card. And hopefully you can skip any incidents that mean you spend your vacation time dealing with a damaged rental.

Our rental experience was great. No hassle on the check-in (I’m highly confident in saying “we have primary car insurance through this card”, so they don’t ever hassle me trying to upsell anymore.) We even scored a nice free upgrade from Economy to SUV (with AWD, appreciated given the snow!) Easy airport drop off near the terminal. The only thing missing was an ice scraper.